Asia in-house legal and compliance hiring trends and salaries, 2017

Asian-mena Counsel is delighted to once again partner with Taylor Root for their 11th annual market update and salary survey report for the legal and compliance in-house sector in Asia, with a focus on Hong Kong, Singapore and China.

2016 review & 2017 outlook

(You can download a PDF version of this report at the foot of this page)![]()

Market Overview

The evolution of the General Counsel function over the past decade from a support function to a business partner has led to increasingly larger, specialised and prominent in-house legal teams. To be a successful General Counsel or in-house lawyer in a multiple jurisdictional region like Asia requires strong business acumen and a holistic view on managing legal, regulatory and reputational risk. With this evolution and the shift in the balance of power from relying on external law firms to specialised internal legal resources, the competition for talent within the in-house legal community has intensified.

At the junior level, not only is a comprehensive knowledge of the law required but it is a prerequisite that lawyers demonstrate both commercial and business acumen.

At the senior level, lawyers now require a thorough understanding of the business, its products and the business environment in which it’s operates. Whether junior or senior, in-house counsel need to deliver high-quality and commercially-focussed legal advice as a business partner.

This evolution has changed the in-house legal landscape with increasing demands on lawyers to manage legal issues in an ever-increasing regulatory environment while at the same time trying to retain control of costs.

This report reviews the Hong Kong, Singapore and China legal and compliance markets in more detail, and also takes a look at average salaries.

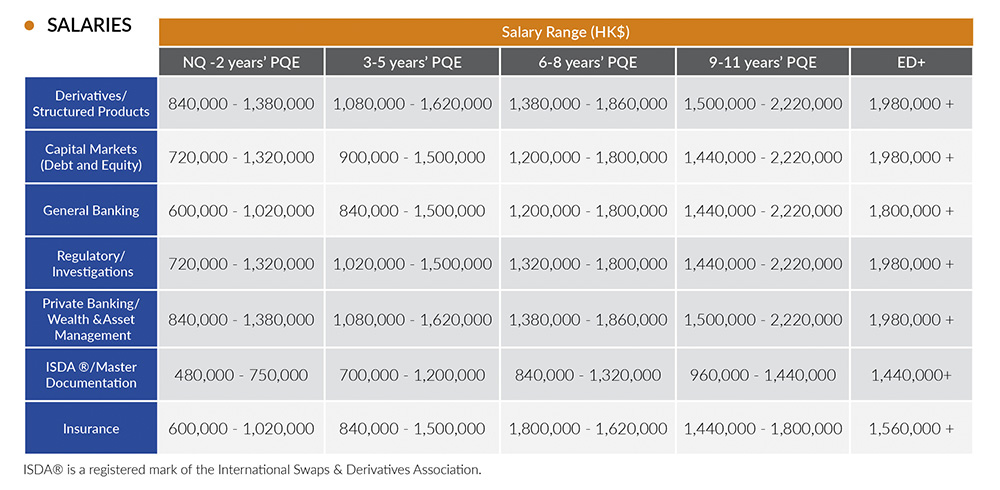

BANKING & FINANCIAL SERVICES

Hiring activity within the investment banking sector remains subdued, reflecting the challenging conditions within the sector globally. Notwithstanding the lower levels of activity within the investment banking sector generally, there has been increased hiring activity within financial markets, with derivatives and structured products lawyers particularly in demand. This has been driven by a shortage of talent and a combination of increased trading activity within these markets, together with ongoing regulatory reform projects as global banks implement the requirements of Dodd-Frank, MiFID II/MiFIR and EMIR reforms, and move to more efficient centrally cleared trading platforms.

Maintaining the trend of recent years, asset manager and funds continue to be a growth sector for in-house legal roles. As more small and mid-cap fund managers increase their exposure, they are increasingly seeing value in adding in-house legal resources. Additionally, as their investments become more diverse and greater in value, these organisations are also under regulatory pressure to ensure that they have sufficient legal and compliance resources in place.

Wealth management also continues to be key growth area within the in-house legal market, with a number of organisations including investment banks, PRC and Hong Kong banks, private wealth management firms and brokerage houses competing to capture a share of the high-net worth market, both in Hong Kong and across North Asia.

As technology platforms have evolved, wealth management firms have been able to provide clients with access to a broader range of products, but have consequently been subjected to increased regulatory pressure, making it imperative for these firms to ensure their legal and compliance teams are adequately resourced. Given the small size of most teams within the wealth management sector, there are a small number of candidates in the market who have specific experience in wealth regulatory advice, client transaction structuring and general commercial advisory.

The market for general banking lawyers’ remains subdued largely due to the stability of teams and the availability of law firm secondees. Transaction banking skill sets such as trade finance, securities services and cash management remain highly sought after however hiring has centred on midlevel rather than senior roles. Key drivers for the consumer finance market are innovation and technology, as banks seek to gain a competitive advantage, win market share and create greater efficiencies of scale in a high volume, low margin market. This comes in addition to increasing pressure on major financial institutions from non-traditional service providers such as electronic payments services, remittance providers, second tier mutual banks/credit unions and mortgage providers.

COMMERCE & INDUSTRY

The Hong Kong commerce and industry markets remains buoyant as demand for in-house counsel continues across the sectors. We have continued to see good levels of recruitment activity across most sectors and multiple hires within Chinese headquartered companies as they expand legal headcount due to business needs and global expansion. As a result to changes to team structure within Hong Kong companies and multinational corporations, there has been a significant amount of movement in the market although the vast majority of roles would be classified as replacement roles rather than increased headcount.

As usual, there is a consistent demand for corporate commercial lawyers, and especially those candidates who have trained with well-regarded law firms coupled with two years of in house experience. Industry specific legal experience is especially important at the senior end of the market and within the retail and FMGC sectors. Given FMCG companies are among the least likely to hire from outside industry, this has led to an above average level of external recruitment at a senior level.

The healthcare and pharmaceutical industries have mirrored the FMCG market in terms of recruitment, albeit primarily at the mid-to-senior Legal Counsel level. There is a continuous demand for lawyers with specific healthcare/life sciences competition and consumer law experience from the healthcare industry in Hong Kong or mainland China, and the industry is typically also one which also hires from within. Candidates with specific TMT/IP background are still sought after particularly in technology companies. Luxury or retail brands were also looking for candidates with either general commercial experience or IP brand enforcement background. Property or real estate lawyers were also in demand.

The healthcare and pharmaceutical industries have mirrored the FMCG market in terms of recruitment, albeit primarily at the mid-to-senior Legal Counsel level. There is a continuous demand for lawyers with specific healthcare/life sciences competition and consumer law experience from the healthcare industry in Hong Kong or mainland China, and the industry is typically also one which also hires from within. Candidates with specific TMT/IP background are still sought after particularly in technology companies. Luxury or retail brands were also looking for candidates with either general commercial experience or IP brand enforcement background. Property or real estate lawyers were also in demand.

Overall, the candidate pool of commercial lawyers in Hong Kong is relatively small and the void is generally filled with capital markets/ banking finance candidates who are then trained in the intricacies of the specific company or industry. For companies with budget constraints, candidates who have worked in local Hong Kong law firms generally have broader and more hands-on experience and are generally considered more affordable from a client’s perspective.

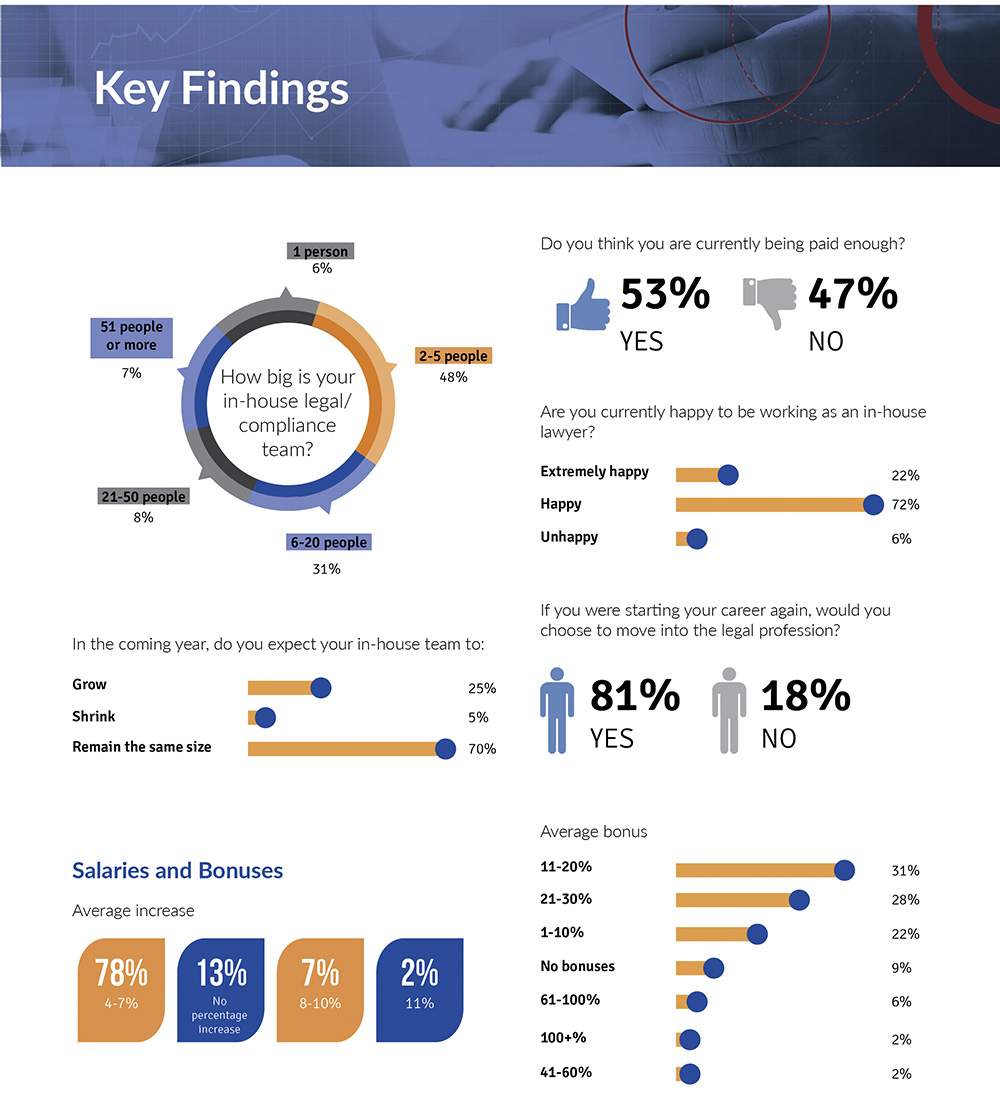

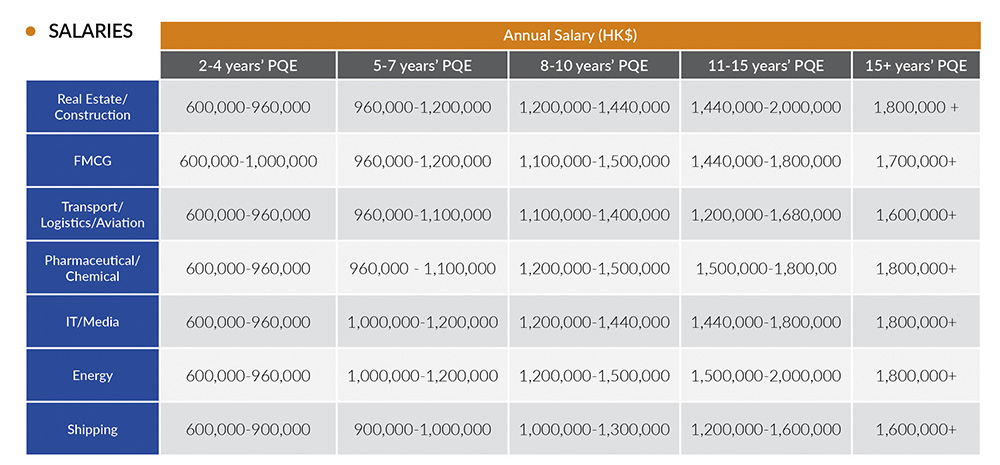

From a salary point of view; there has been an overall increase in salaries at the mid-level, particularly 4-7 years’ PQE. While this no doubt reflects the increasing demand at this level, many organisations have demonstrated a willingness to pay more to attract high calibre lawyers to their in-house legal teams, providing a strong talent pipeline. Conversely, at the senior end of the market, there has been little movement in terms of remuneration. While senior candidates can expect an uplift should their role change in scope, whether by the inclusion of greater leadership or regional responsibilities, there has been little evidence of anything other than incremental increases at the senior end of the market.

COMPLIANCE

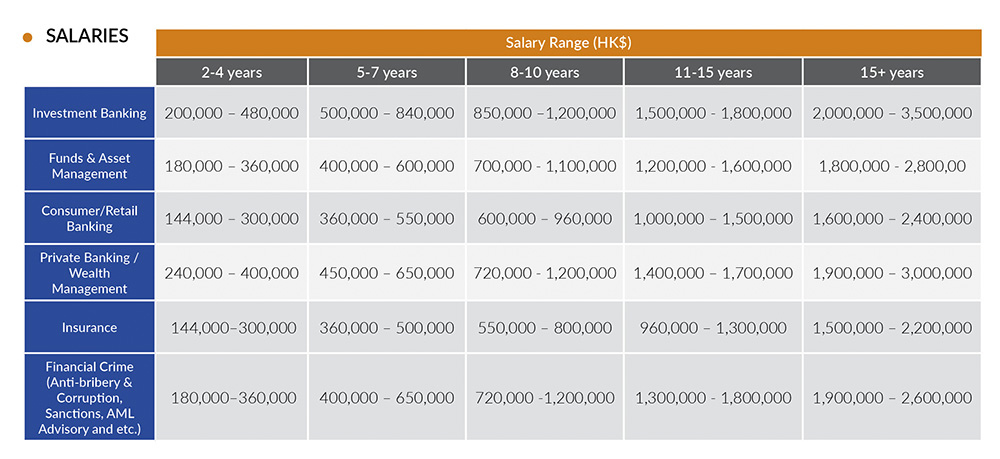

The responses to our survey make more positive reading than we anticipated four months ago. Compliance department heads report they are still under staffed and are committed to recruit more compliance professionals for rest of 2017 in Hong Kong. The current demand trend is away from top tier investment banks to the wider financial services industry including the emergence of new providers such as Fintech companies and mid-size financial services groups. While compliance professionals with highly specific skills remain scarce and are in huge demand, there is a strong desire to promote internally and backfill the junior vacancies.

Fintech companies currently offer various types of financial products including loans, mortgages, and payments across digital banking, foreign exchange. There will be an increasing number of compliance roles in the next 12 to 24 months as regulators such as SFC continue to focus on them. A further source of demand is from the insurance sector as they come under greater regulatory scrutiny. They will continue to drive demand following the once dominant banking sector. The insurance authority will need to hire experts in the region to assist with this matter and hence there will definitely be tighter rules set in place as the regulations will enhance protection to the policyholders from the mainland and Hong Kong.

Banks will try to avoid costly compliance failings by hiring more staff and continue expansions of their KYC/AML teams. Growing belief amongst industry insiders is that compliance needs to be understood as an attitude and a culture, not just as a departmental function. AML and Products Compliance specialists will continue to be in high demand in Q2 through Q4 2017.

In 2016, the SFC has proposed to enhance asset management regulation and point-of-sale transparency to enhance the regulation of the asset management industry in Hong Kong to better protect investors’ interests and ensure market integrity. In response, hedge fund managers/ private equity firm have been expanding their compliance capabilities. The demand on regulatory compliance professionals in hedge fund/ PE has been increasing especially with Chinese-based companies. We see more new headcounts in AML compliance within the traditional asset management fund houses this year. Given the lack of AML professionals in the asset management industry, it is a highly competitive niche area to secure employment in.

The investment banking recruitment markets have slowed due to the decrease in recruitment from the larger banks. As banks’ costs are being cut, this sector has become very vacancy focused and most of the vacancies are relied on direct sourcing. However, within the markets compliance space, it has still been a very candidate led market. We also see an increase in demand on hiring compliance specialists in Chinese Banks.

BANKING & FINANCIAL SERVICES

The banking and financial services industries in Singapore have continued to grow steadily in the past year; though with certain sectors registering markedly higher recruitment activity than others. Notably, this was seen mainly in the financial services industries. Particularly, it has been the payments services and FinTech companies who have bolstered their legal capabilities, alongside their corresponding business growth. Buy-side institutions such as asset managers and private equity/hedge funds have also deviated slightly by focusing on building their teams with junior lawyers, instead of the typical practice of taking on experienced hires at the mid-senior levels.

Global changes for banks have seen most legal teams maintaining their team size, save for replacement hiring that occurred as a result of natural attrition. However, it is worth noting that some banks’ efforts to reduce costs have seen them either trying to relocate legal functions to lower cost centres offshore, or to automate, as far as possible, legal services (of a less sophisticated nature) by way of consolidated templates and workstreams. The short term impact of this is likely to reduce demand for lawyers in the banks at the junior levels, whilst its feasibility and impact in the medium to long term remains to be seen.

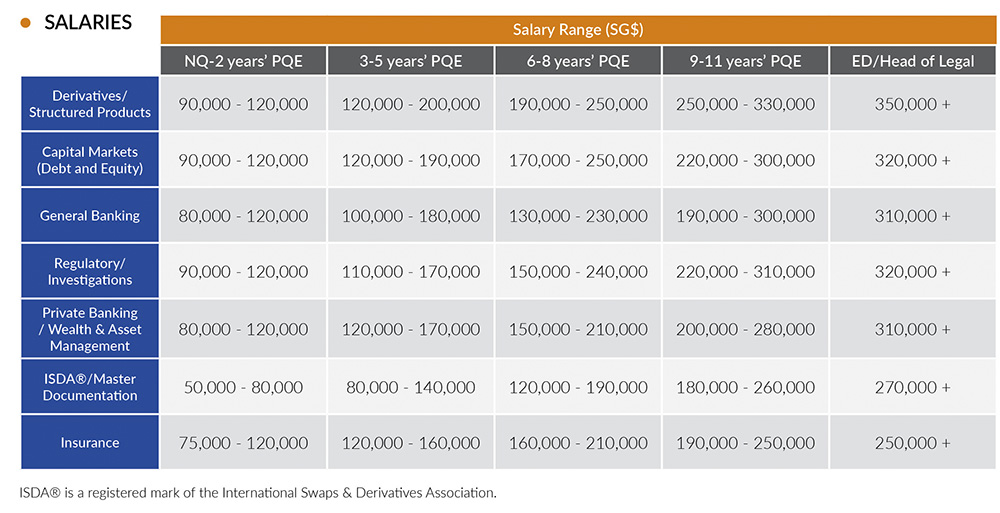

Skill sets in demand have primarily been in niche areas for custody/securities services, derivatives and regulatory lawyers.

Additionally, there has also been renewed demand for generalist corporate transactional lawyers, albeit with Mandarin language skills, given the increased contact firms are having with Chinese clients. ISDA negotiators, who do not form the purview of qualified lawyers exclusively, continue to be sought primarily within banks, for both contract and permanent positions.

The majority of in-house legal counsels continue to report strong levels of job satisfaction, citing the intellectual challenge and relatively flexible nature of their role as attractive features of their chosen career path. Many have also maintained realistic salary expectations, given the healthy attitude to bonus levels averaging 15-20% in the past year. Salary adjustments, whilst modest (averaging around five per cent), have been unsurprising.

Going by the strong activity levels we have seen from the start of 2017, and barring any significant policy changes within the broader economy, the outlook for the rest of the year remains positive.

COMMERCE & INDUSTRY

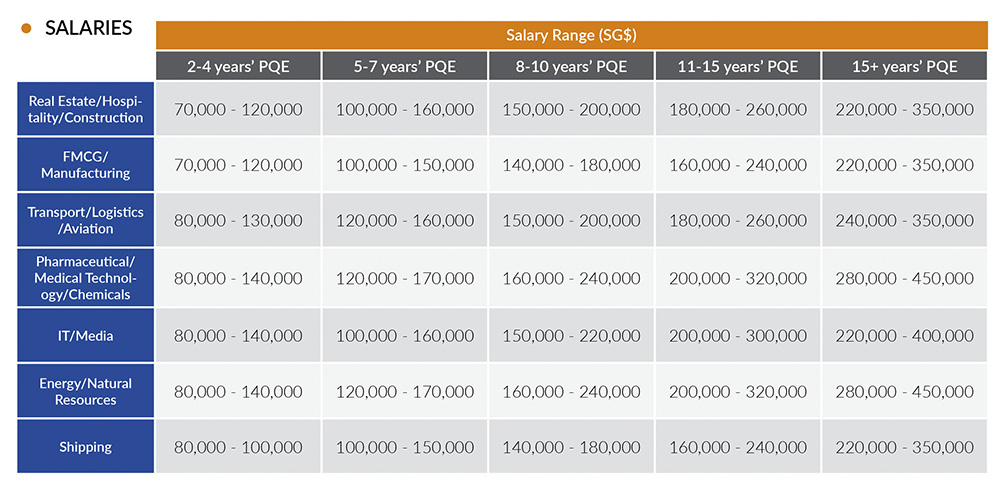

Recruitment throughout 2016 remained steady despite a cautious economic outlook. Softening growth across the US and PRC economies have resulted in a modest pace of growth across most industries in Singapore and the region. However, we continue to see strong growth in the technology and life sciences industries, and expect this recruitment trend to continue through to 2017.

Within the pharmaceutical, medical devices and life sciences sectors; Singapore remains a key regional hub as global multinationals base APAC head offices here. Besides newly created roles at the mid to senior level to establish the legal function in APAC, we also see expansion or replacement position roles for junior lawyers. As the industry tends to be highly regulated, prior industry experience is highly favoured.

Demand for technology lawyers remains strong, both from the technology industry itself and from the broader corporate sector. As all businesses focus on digitalisation, data analytics and innovation, the recruitment of dedicated technology lawyers for in-house teams has become essential for most large corporates, in addition to supporting internal IT contracting, procurement and outsourcing needs.

Demand for technology lawyers remains strong, both from the technology industry itself and from the broader corporate sector. As all businesses focus on digitalisation, data analytics and innovation, the recruitment of dedicated technology lawyers for in-house teams has become essential for most large corporates, in addition to supporting internal IT contracting, procurement and outsourcing needs.

Smaller, dynamic MNCs in the areas of software, cloud computing, data analytics and the digital sector are starting to recruit for their first regional counsel on the ground in Singapore. Compensation tends to vary widely depending on the size and stage of the company’s growth. Base salaries on offer tend to be much lower in comparison to what larger, more established companies can offer, but this is compensated with generous equity options.

Across other sectors such as oil and gas, commodities, maritime and resources, recruitment has remained quite flat, with hiring mostly for replacement roles.

The manufacturing / semiconductor industries remain volatile and cyclical, with low profit margins and low turnover. We also saw consolidation in the hospitality sector, with a rise of mergers & acquisitions as companies sought to increase market share.

Whilst restructuring and integration created opportunities, local and highly-qualified candidates were sometimes overlooked as some companies chose to relocate internal candidates with a deep pool of industry knowledge, despite the lack of APAC experience.

COMPLIANCE

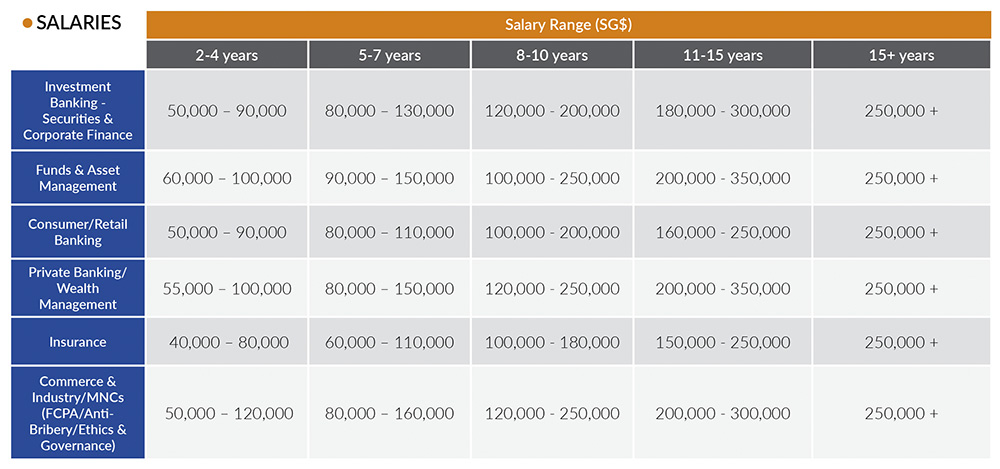

The compliance market in Singapore has undoubtedly seen an overall slow-down in recruitment in 2017 as compared to last year. We will continue to see a need for hiring in certain sectors of the Financial Institutions, especially within the Asset Management, Private Bank/Wealth Management and Fintech. Hiring, bonuses and increments in these sectors have been healthy with average bonuses ranging between 3-4 months and increments when switching jobs range between 15-20%.

On the contrary, compliance professionals in Consumer banking and Corporate Investment Banks would have seen better days. Bonuses in these sectors range between 0-2 months and a handful of smaller outfits are on hiring freeze due to budget cuts. Salary increments between jobs are on average between 10-15%.

Financial Crime Compliance will remain as a huge focus in 2017 recruitment, particularly in Anti-Money Laundering with MAS tightening their regulations. There has been a shortage of strong talents in this area, especially between 6-10 years of experience, with well-qualified candidates commanding a bigger salary raise. There is also an increasing emphasis on experts with risk management and investigations experience within FCC, often in the form of newly created positions.

Financial Crime Compliance will remain as a huge focus in 2017 recruitment, particularly in Anti-Money Laundering with MAS tightening their regulations. There has been a shortage of strong talents in this area, especially between 6-10 years of experience, with well-qualified candidates commanding a bigger salary raise. There is also an increasing emphasis on experts with risk management and investigations experience within FCC, often in the form of newly created positions.

Regulatory compliance has been in demand within the asset management space. Coupled with business compliance experience, mid to senior level candidates can expect to hear from the top-tier fund/asset management firms this year on exciting opportunities. Senior professionals (10 years +) in this area can expect to be paid 10-15% more than peers in other sectors of the finance industry. While the corporate investment banks, private banks and retail banks have always had a steady need for professionals in regulatory compliance, it seems that there has been less focus on replacement hires and a shift towards distributing responsibilities to existing team members.

Most candidates are motivated to join an organisation with a track record of promotion from within and the opportunity to gain exposure in other specialisations. With more organisations going through restructuring, many seek clarity on team and reporting structure when they are looking for a switch. Although most candidates are financially motivated, having the right environment and strong development plans can help them moderate their expectations on monetary incentives.

COMMERCE & INDUSTRY

The China in-house legal market remained relatively buoyant in 2016 and we expect it to continue active in 2017. We have seen a steady flow of in-house legal positions at the mid to senior levels, and head of legal roles in middle-sized enterprises. The most coveted candidates are corporate lawyers with existing in-house experience and previous law firm practice, and personality fit remained a high priority with a focus on communication skills and business sense.

As the growth of manufacturing and construction industries continues to slow in China, the majority of openings in this sector are replacement hires. And we noticed that the remit for the replacement roles has often been wider than the original roles with the expectation for the new lawyers to cover more areas and save cost. We saw new roles in more touted industries, e.g. healthcare and life sciences, as well as consumer and service industries. Alongside this, there was a prominent trend across the retail, hospitality and entertainment sector in starting up and strengthening their e-commerce platforms.

Due to the increasing awareness of the value of intellectual property and the dramatic development of on-line business in China, brands are more aggressive in protecting their intellectual property so that IP talent is highly sought-after. The demands of M&A lawyers tend to be increasing from domestic enterprises as they are looking for strategic ways to expand both domestically and internationally. More candidates with an international background are open to domestic companies, however, still facing the challenges of fitting in the company culture.

When seeking a move, junior candidates are keen to consider the compensation, good brand and legal team size as the key factors, while senior candidates pay more attention to stability, people management and company culture. The salary increase expectation of an existing in-house counsel is usually 20-30% but we ultimately found 15-25% more realistic. Lawyers from law firms looking for the first in-house position usually have more flexibility on the salary with opportunities for career progression, expectation for work and life balance, and potential upside in annual discretionary bonus.

工商业

中国大陆的工商业企业法务市场2016年较前一年相对活跃,预计2017年仍会维持该状态。其中,中等规模企业的中高层职位以较为稳定的频率产生新的空缺。同时具有律师事务所执业经验及企业内部法务经验的律师仍然是最受市场欢迎的群体,拥有良好的沟通能力和商业意识也可以从众多律师中脱颖而出。

随着传统的生产制造业,建筑业在中国大陆的增幅放缓,这些行业的企业不会轻易创造新的职位,多为替换性职位。并且在替换性的职位产生时,企业往往要求候选人比前任负责更大范围的工作职责,用来削减成本。而在医疗器械,生命科学,快速消费品及专业服务性行业中的企业,由于业务的发展,多会创造出新的工作岗位。娱乐和电子商务行业的企业在创造新的企业法务职位上表现尤为突出。

由于知识产权保护意识的提高,以及中国大陆线上业务的快速发展,各品牌开始积极的重视自身的品牌保护;因此知识产权相关专业人才备受关注。投资并购专业律师也因为本土企业的大幅对外扩张业务而显得尤为稀缺。尽管会面临适应

全新企业文化的挑战,越来越多拥有国际教育工作背景的候选人仍选择投身于本土企业。

初级律师看机会的时候会更在意公司的品牌,法律团队的大小,以及福利待遇;而中高级律师在找寻新的工作机会的时候会更看重公司的管理层风格及企业文化。在公司企业法务岗位之前换工作的平均薪资涨幅约为20%-30%,但是从实际情况来看15%-25%是更容易达成的范围。律师事务所的职业律师在找寻企业法务岗位的时候对薪资的需求较为灵活,因为他们会更看中工作和生活的平衡型,已经长期的发展。